Table of Contents

Amazon’s stock saw a significant boost after the company reported better-than-expected earnings, bolstered by strong performance in its cloud division, Amazon Web Services (AWS). The earnings beat highlights Amazon’s resilience amid challenging economic conditions and reflects the company’s continued success in diversifying its revenue streams beyond retail.

Here’s a breakdown of Amazon’s recent earnings and how cloud growth continues to drive the company’s financial success.

Earnings Highlights

Amazon’s latest quarterly report surpassed Wall Street expectations, with notable performance across several business units. The company’s revenue and earnings per share (EPS) both exceeded analyst forecasts, signaling robust demand and operational efficiency. Amazon attributed part of its success to its strong e-commerce platform and efficient logistics network, which have helped the company maintain its competitive edge.

Key Financial Metrics:

- Revenue: Amazon reported revenue of $143.1 billion, a 13% year-over-year increase, beating the estimated $141.5 billion.

- Earnings Per Share (EPS): The company posted an EPS of $0.94, significantly higher than analysts’ expectations of $0.60 per share.

- Operating Income: Operating income increased by 40% to $11.2 billion, reflecting operational improvements and efficient cost management.

Cloud Division: AWS Powers Amazon’s Growth

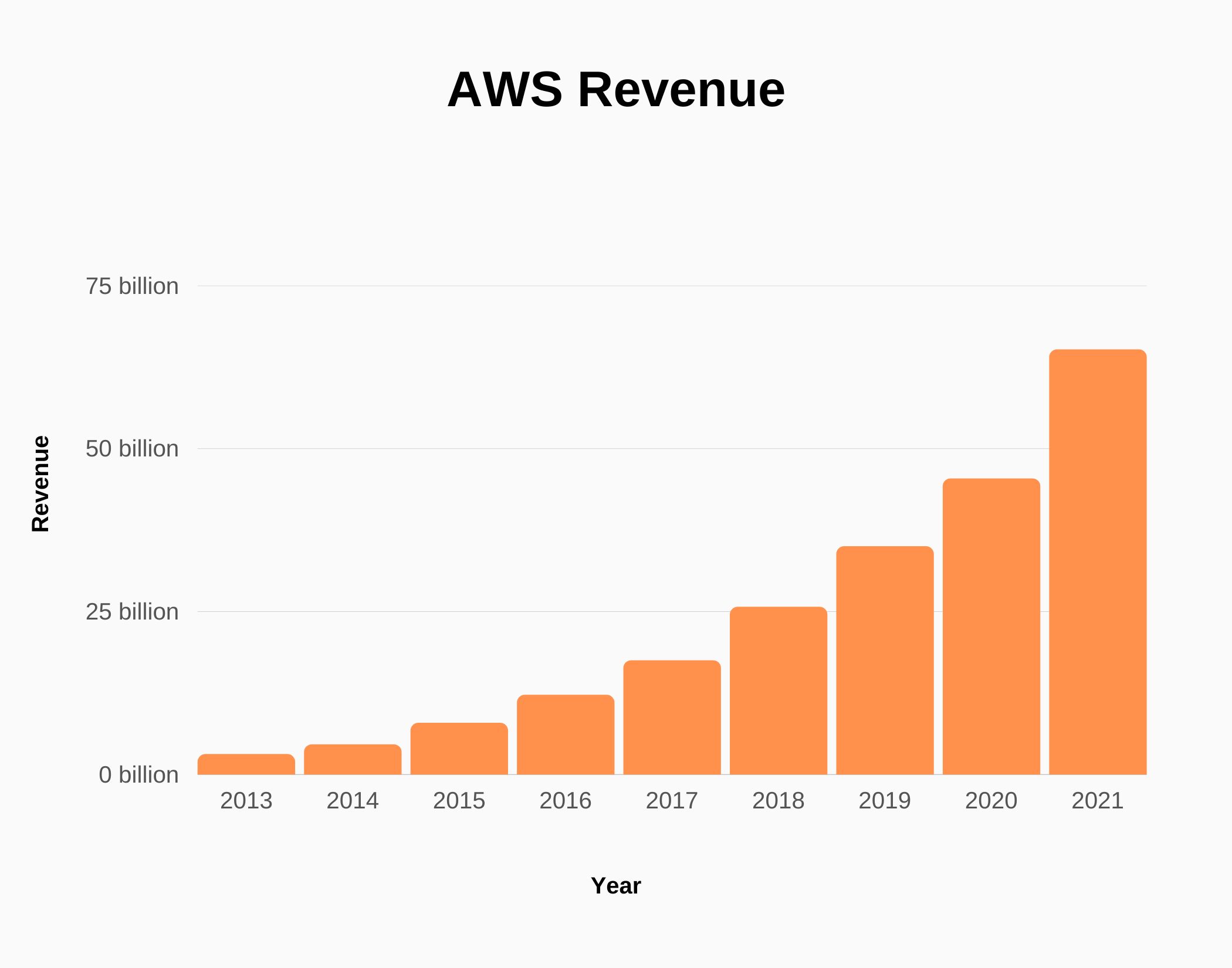

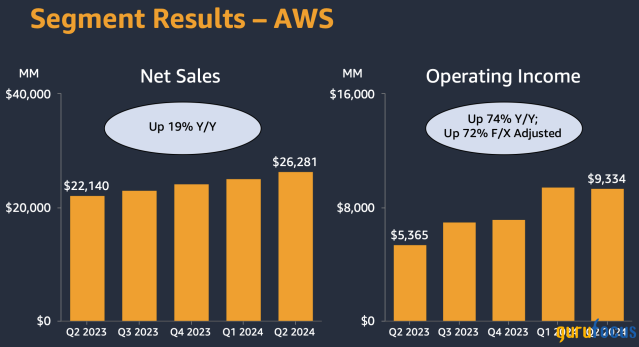

Amazon Web Services (AWS), the company’s cloud computing arm, remains a major growth driver for Amazon. AWS’s revenue grew 12% year-over-year, driven by increased adoption across various industries, as companies continue to rely on cloud solutions for their digital transformation initiatives. Despite an economic slowdown impacting IT budgets in some sectors, AWS has maintained its upward momentum, benefiting from its extensive portfolio of services and infrastructure.

Why AWS Matters

AWS contributes a substantial portion of Amazon’s overall profits, with high operating margins compared to its retail operations. While AWS accounts for only about 16% of Amazon’s total revenue, it generates a significant portion of its operating income, underscoring its importance to the company’s financial health.

AWS Revenue Growth Highlights:

- Revenue: AWS reported $23.1 billion in quarterly revenue, representing a 12% increase from the previous year.

- Operating Margin: AWS’s operating margin of 30% highlights its profitability, especially compared to the lower margins typical in e-commerce.

Market Position:

AWS remains a leader in the cloud computing market, competing closely with Microsoft Azure and Google Cloud Platform. Its ability to retain and expand enterprise clients has helped it sustain a competitive edge, even as Microsoft and Google ramp up their cloud services. AWS’s comprehensive service offering—from infrastructure as a service (IaaS) to machine learning and artificial intelligence (AI)—continues to attract a diverse customer base.

Factors Driving AWS Growth

Several factors have contributed to AWS’s steady growth, even in an increasingly competitive cloud market:

- Digital Transformation: Organizations worldwide are investing in digital infrastructure to improve efficiency, scalability, and agility. AWS has been a key enabler of this shift, providing solutions for data storage, processing, and advanced analytics.

- Expanding Product Portfolio: AWS regularly introduces new services and enhancements, addressing the evolving needs of businesses across sectors. Recent expansions in machine learning, AI, and data analytics have positioned AWS as a preferred partner for organizations undertaking digital transformation.

- Cost Optimization Initiatives: AWS’s continued focus on cost-effective solutions, including tiered pricing and efficient resource allocation, has helped attract cost-conscious customers, particularly as companies manage tighter IT budgets.

- Global Reach: AWS’s global infrastructure spans 31 regions and numerous availability zones, offering customers local data residency options and low-latency access, which is critical for global enterprises.

Market Reaction and Investor Sentiment

Amazon’s positive earnings report and robust AWS performance have bolstered investor confidence. Following the earnings release, Amazon’s stock price rose more than 6% in after-hours trading, indicating strong market approval of the company’s performance and outlook.

Analyst Takeaways:

Several analysts have raised their target prices for Amazon, citing AWS as a “catalyst for growth.” The cloud segment’s resilience amid economic headwinds has positioned Amazon well for future growth, with AWS projected to benefit from increased demand for cloud-based AI and machine learning applications.

Investor Sentiment:

Investors view Amazon’s earnings beat as a signal that the company is well-positioned to navigate economic uncertainty. The success of AWS, combined with Amazon’s diversified revenue streams, offers a promising growth outlook, reassuring shareholders about Amazon’s long-term strategy.

Future Outlook for AWS and Amazon

Looking ahead, Amazon aims to capitalize on emerging trends in AI and machine learning. The company’s investment in AI-driven cloud solutions is expected to pay off as businesses adopt these technologies to gain competitive advantages. AWS is likely to continue benefiting from organizations’ digital transformation efforts, with anticipated growth in areas like serverless computing, big data analytics, and cloud security.

Amazon CEO Andy Jassy emphasized the importance of cloud and AI, stating:

“AWS remains a foundational component of Amazon’s growth strategy. As organizations increase their focus on cloud, data, and AI-driven transformation, we’re committed to providing the best-in-class tools and infrastructure to support them.”

With AWS leading Amazon’s growth, analysts expect sustained momentum in the company’s earnings, bolstered by strategic investments in emerging technologies and expanding service offerings.

Conclusion

Amazon’s latest earnings report underscores the importance of AWS to the company’s financial success. The cloud division’s growth, combined with Amazon’s strategic positioning across various markets, has solidified its status as a dominant player in both e-commerce and cloud computing. For investors and analysts alike, the performance of AWS is a reassuring indicator that Amazon remains well-prepared to capitalize on the future of cloud computing and digital transformation.

For more industry insights and financial analysis, follow Cerebrix on social media at @cerebrixorg.

Liam Chen

Tech Visionary and Industry Storyteller

Read also

November 19, 2024

November 19, 2024

November 19, 2024