Table of Contents

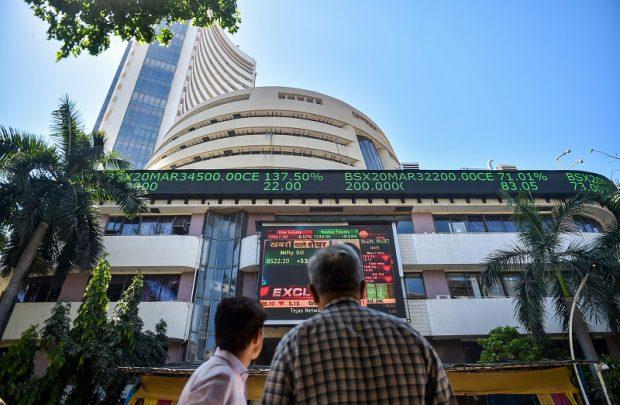

The Indian stock markets witnessed significant activity today as the BSE Sensex surged to a record high during intraday trading, only to end the session slightly lower. The NSE Nifty 50 index, meanwhile, remained relatively flat but managed to hold above the critical 26,000 mark.

Sensex Performance: Record High, Slightly Lower Close

The Sensex, India’s benchmark index, rallied earlier in the day to hit a new all-time high, driven by strong investor sentiment and a rally in banking, IT, and auto stocks. However, late-session profit booking led the index to close marginally lower from its peak.

- Intraday High: The Sensex surged to a record high of 66,080.53 points before retreating slightly by the end of the trading session.

- Closing Figure: The index ended the day at 65,920.56 points, down by 0.12% from the intraday high.

Market analysts attribute the initial gains to robust domestic inflows and positive global cues. However, some profit-taking occurred in sectors like FMCG and pharma, contributing to the index’s slight decline in the closing hours.

“The market was riding high on strong quarterly earnings results, particularly in the banking and IT sectors, but late-session profit booking pulled it slightly down. Overall, the sentiment remains positive with a long-term bullish outlook,” said Rajesh Palviya, Head of Technical Research at Axis Securities (source).

Nifty 50: Flat but Holds Strong Above 26,000

The Nifty 50 index traded in a narrow range throughout the day, closing flat but managing to remain above the important 26,000 level, a key psychological barrier for investors.

- Closing Figure: Nifty ended at 26,045.85 points, a marginal gain of 0.02% for the day, highlighting the market’s resilience despite global uncertainty and some sectoral weakness.

The Nifty’s performance was supported by gains in the financial and IT sectors, though the overall market breadth remained mixed. Notably, Reliance Industries and HDFC Bank were among the top gainers, helping the index maintain its position above 26,000.

Sectoral Highlights: Banking and IT Lead Gains

Among the major contributors to today’s gains were banking, IT, and auto stocks, which saw significant buying interest throughout the day.

- Banking Stocks: Shares of major banks like ICICI Bank, State Bank of India (SBI), and HDFC Bank saw strong buying interest, driven by optimism around their quarterly earnings results and robust growth outlooks.

- IT Sector: The IT sector, led by companies like Infosys and Tata Consultancy Services (TCS), also contributed to the market’s gains, as investors remain bullish on the sector’s growth prospects, particularly in the export market.

- Auto Sector: Auto stocks, including Tata Motors and Mahindra & Mahindra, continued their upward momentum, supported by strong sales data and a positive demand outlook.

On the flip side, sectors like FMCG and pharma saw some weakness, with profit booking weighing on the indices in these areas.

“Banking and IT stocks were the top performers today, driven by strong earnings expectations and positive market sentiment. Meanwhile, sectors like FMCG and pharma saw some correction due to profit booking,” said Saurabh Mukherjea, Founder of Marcellus Investment Managers (source).

Global Cues and Market Sentiment

Positive global market cues, particularly from Wall Street, supported the Indian markets’ bullish trend earlier in the day. Investors were encouraged by strong U.S. economic data and optimism around central bank policy in developed markets. However, concerns over inflation and global recessionary fears continue to linger, leading to some caution among investors in the Indian markets.

Key Drivers Behind the Record High

Several factors contributed to the Sensex’s record high and the strong performance of the Nifty 50:

- Strong Corporate Earnings: Solid quarterly results from top companies, particularly in the banking and IT sectors, have bolstered market confidence.

- Robust Domestic Flows: Domestic institutional investors (DIIs) and retail investors have continued to pump money into Indian equities, supporting market momentum.

- Positive Global Sentiment: Uplift in global markets, particularly driven by optimism over central bank policies, provided a favorable backdrop for Indian equities.

“The Indian markets are riding high on robust earnings and liquidity flows. As long as global conditions remain stable, we could see further upward movement, especially with the banking sector leading the charge,” commented Anand Rathi, founder of Anand Rathi Wealth Management (source).

Outlook: Long-Term Bullish Trend

Despite the minor dip at the close, market analysts remain optimistic about the long-term outlook for the Indian stock markets. Strong corporate earnings, healthy domestic inflows, and robust macroeconomic indicators are expected to continue supporting the market in the near term.

Investors are now looking ahead to key events such as the U.S. Federal Reserve’s policy meeting and the release of upcoming economic data, which could influence market sentiment going forward.

For more updates on Indian market trends and global stock news, follow @cerebrixorg on social media!

Ethan Kim

Tech Visionary and Industry Storyteller

Read also

November 19, 2024

November 19, 2024

November 19, 2024